Upon fast growth and market volatility, a family investment policy becomes essential or a driver towards long-term investment planning.

An investment policy is a statement that describes a family’s parameters for investing their funds and identifies the investment objectives, while documenting the roles and responsibilities of family office executives, committees and advisory boards. Upon the document is also disclosed the guidelines of benchmarks, allocation, restrictions or requirements, tolerance for risk, constraints on the investment portfolio, and how the investment program will be managed and monitored.

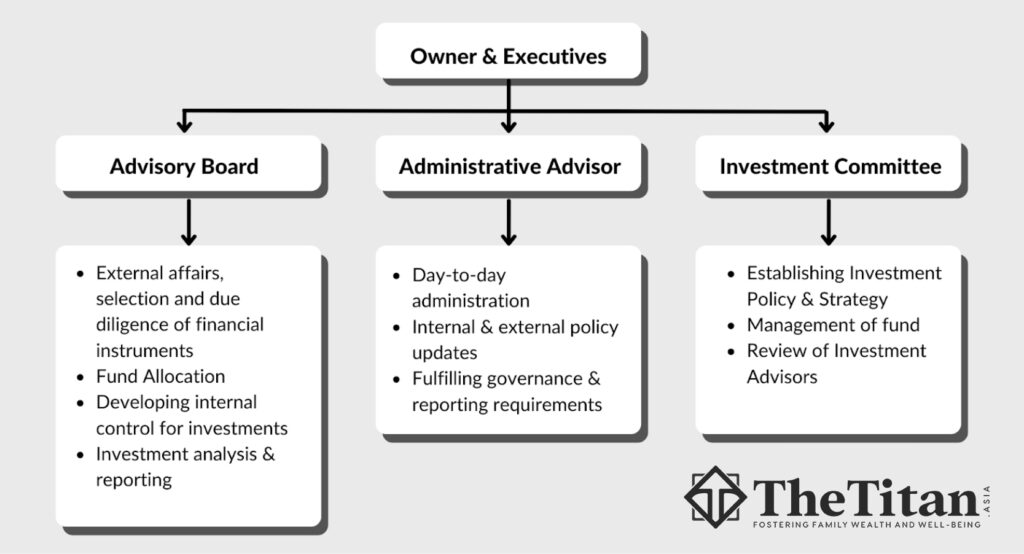

With the extent of information comprised, this document acts as a communication vessel for all the parties involved in managing the family’s portfolios. The legislative party in this matter would be referred to as the Investment Committee. And the role of fund allocation, analysis and due diligence is addressed to the Advisory Board. Our basic approach into constructing a family office structure shall include the following parties.

We have tailored globally renowned approaches into structuring a Family Office Investment Policy, which are adjusted to the nature of the HNWI/UHNWI segments in Indonesia.

1. Investment objectives

The objective shall be a comprehensively made consensus of the parties which funds are allocated towards investments as a Family Office. Family patrons and members shall discuss amongst themselves:

- Allocations

- Capital Preservation

- Liquidity preferences

- Risk preferences

- Desired Return

- Preferred asset types and diversification method

- List down specific goals of the investment program: business or asset expansion, risk diversification, philanthropic goals, and such.

2. Investment Program Structure

Define the structure surrounding the family’s investment activities, their roles, qualifications, responsibilities and authorities. Separations of roles and risk of fraud shall be top of mind when generating the structure.

3. Investment Guide

Guidelines on selecting investment or asset types. This will include, such as, the procedures of selection, comparison methods and standards of risk and performance.

4. Reporting Standards

The terms on what should be included in the report, reporting methods, benchmarks and performance standards, and the frequency of reporting.

A thoroughly constructed investment policy statement can be key to achieve common understanding among the family and advisory side and enhance the family’s investment activities. Given the recent occurrences of market volatility, updates on regulatory law, and both private and governmental investment programs on specific sectors, The Titan is equipped with advisors with extensive lines of expertise that are ready to aid you in constructing your investment strategies and guiding your family towards investment success.